Table of Contents

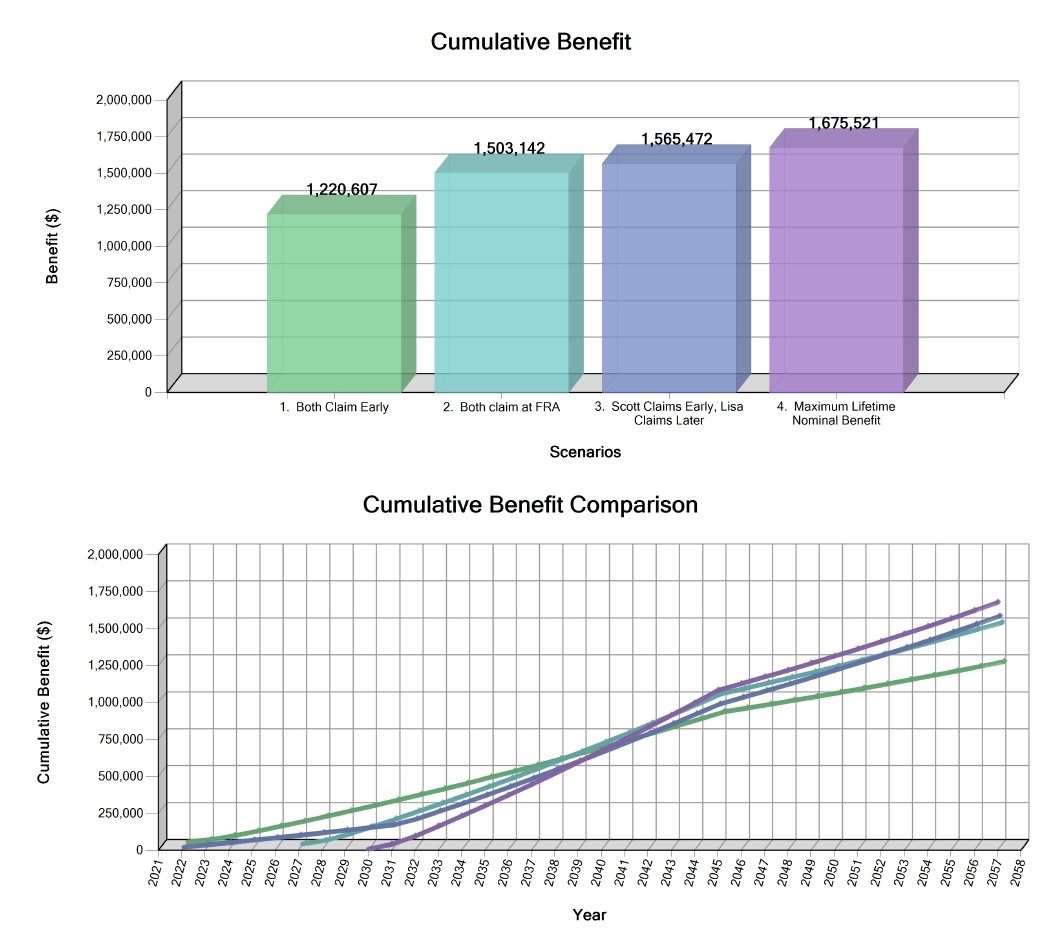

- What Is The Maximum Social Security Withholding For 2025 - Alfy Louisa

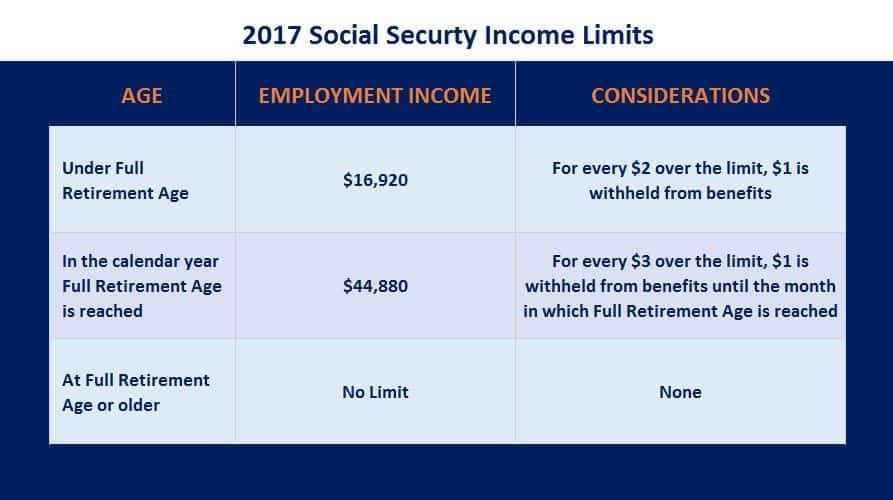

- Social Security Income Limits 2017 - Social Security Intelligence

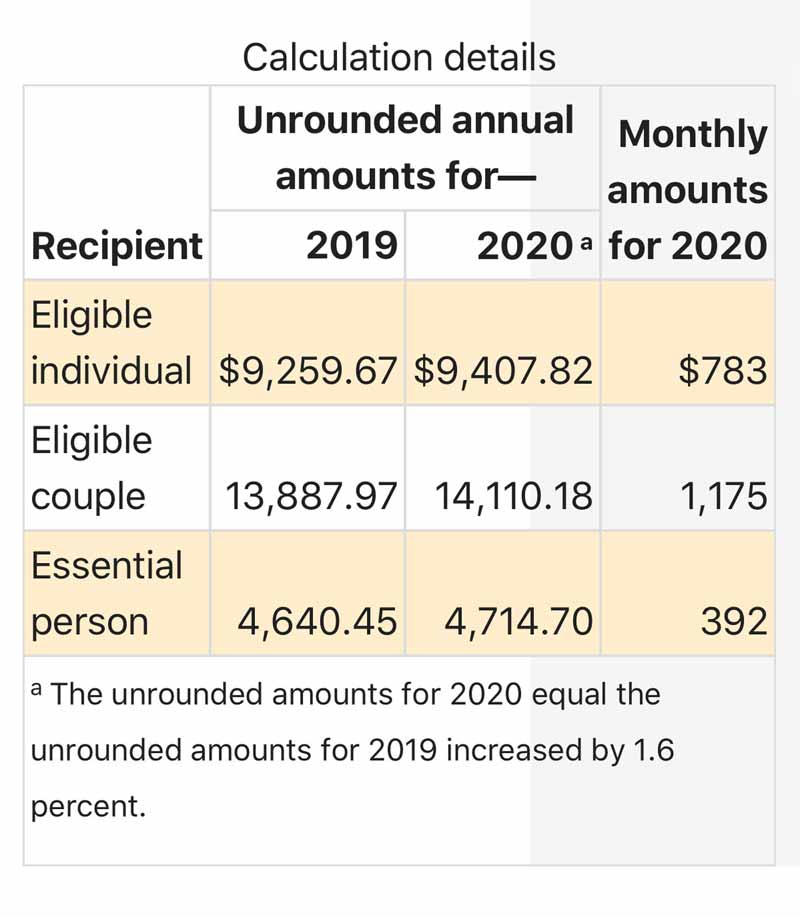

- Supplemental Security Income Increase 2024 - Erika Jacinta

- 8 Social Security Increase 2024: Get More Details – Steve DiGioia

- Social Security earned income limits in 2024 is k - YouTube

- Social Security Cola Increase For 2025 | SS SSI SSDI Low Income ...

- 2024 Social Security Increase Percentage - Cody Mercie

- Seniors get slight boost for 2024 Social Security checks | Fox Business

- Will Supplemental Security Income rise in 2024 | JUST PASSED | Social ...

- CONFIRMED! Social Security BIG CHANGE in 2024 | SS SSI SSDI Low Income ...

What is COLA and Why is it Important?

2026 COLA Forecast: A Disappointing Outlook

The implications of a lower COLA are far-reaching, affecting not only the financial security of beneficiaries but also their overall well-being. With a smaller increase, many individuals may struggle to afford basic necessities, such as food, housing, and healthcare. This can lead to a decrease in quality of life, increased stress, and a higher risk of poverty among vulnerable populations.

Impact on Social Security Beneficiaries

The updated COLA forecast will undoubtedly have a significant impact on the lives of Social Security beneficiaries. With a lower increase, many individuals may need to make difficult choices between essential expenses, such as: Reducing spending on non-essential items Cutting back on healthcare expenses Decreasing food budgets Delaying retirement or returning to work These decisions can have long-term consequences, affecting not only the individual but also their families and communities. The 2026 Social Security COLA forecast is a stark reminder of the financial uncertainty faced by millions of beneficiaries. While a 2.5% increase may seem like a modest boost, it's essential to consider the broader context and the potential implications for those relying on Social Security benefits. As the economic landscape continues to evolve, it's crucial for policymakers to prioritize the needs of vulnerable populations and work towards creating a more sustainable and equitable Social Security system. By understanding the updated COLA forecast and its potential impact, we can better prepare for the challenges ahead and advocate for policies that support the financial security and well-being of Social Security beneficiaries. As we move forward, it's essential to stay informed and engaged, ensuring that the voices of those affected are heard and their needs are addressed.For more information on the 2026 Social Security COLA forecast and its implications, please visit the official Social Security Administration website or consult with a financial advisor. Stay tuned for further updates and analysis on this critical issue.

Note: This article is for informational purposes only and should not be considered as financial advice.